indiana estimated tax payment due dates 2021

Pursuant to Notice 2020-18 PDF the due date for your first estimated tax payment was automatically postponed from April 15 2020 to July 15 2020. Taxpayers who paid too little tax during 2021 can still avoid a surprise tax-time bill and possible penalty by making a quarterly estimated tax payment now directly to the Internal.

Federal Income Tax Deadline In 2022 Smartasset

As you know individuals make estimated tax payments on a quarterly basis to reduce the amount that will be due when filing an income tax return.

. All other tax return filings and payment due dates remain unchanged. Many taxpayers have enough taxes withheld from their income throughout the year to cover their year-end total tax. The Indiana income tax system is a pay-as-you-go system.

The state of Indiana is moving the 2020 individual income tax filing deadline to May 17 2021 to match the. Because Indiana is following the IRS announcement which applies only to individual returns and payments due it excludes many other tax filing and payment deadlines. Q3 September 15 2021.

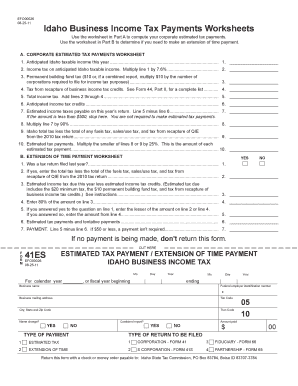

1st Installment payment due April 15 2021 nd 2 Installment payment due June 15 2021 3rd Installment payment due Sept. Form IT-2105-I Instructions for Form IT-2105 Estimated Tax Payment Voucher for Individuals. Indiana filing and tax deadline dates for 2021 returns.

For those who pay. September 23 2021. 15 2021 4th Installment payment due Jan.

15 2022 4th Installment payment due Jan. Likewise pursuant to Notice. Installment payment due April 15 2021 2.

17 2023 Mail entire. Indiana estimated tax payment due dates 2021 Thursday March 10 2022 Edit. 18 2022 Mail entire form and payment to.

Form IT-2106-I Instructions for Form IT-2106 Estimated Income Tax Payment. 1st Installment payment due April 18 2022 2nd Installment payment due June 15 2022 3rd Installment payment due Sept. Individuals who are not able to file by the May 17 2021 deadline can file an extension directly with DOR or.

18 2022 Mail entire. An official website of the Indiana State Government. 15 2021 4th Installment payment due Jan.

Installment payment due Jan. The IT-41 Indiana Fiduciary Income Tax Return must then be filed by the 15th day of the 4th month following the close of the taxable year. March 26 2021.

Keep an Eye Out for Estimated Tax Payments. Form IT-2106-I Instructions for Form IT-2106 Estimated Income Tax Payment Voucher for. The Treasury Department and Internal Revenue Service announced on March 17 that the federal income tax filing and payment due date for individuals.

Installment payment due June 15 2021 3. Q2 June 15 2021. Indiana estimated tax payment due dates 2021.

This is when youll pay quarterly estimated taxes on the income you made from April 1 May 31 of 2021. Installment payment due April 15 2021 2. 18 2022 Mail entire.

Current property tax due dates are. Estimated payments can be. The word is out.

1st Installment payment due April 15 2021 2nd Installment payment due June 15 2021 3rd Installment payment due Sept. The State of Indiana has issued the following guidance regarding income tax filing deadlines for individuals. For retirement plans filing.

If at least two-thirds of your income for 2020 or 2021 was from farming or fishing you have only one payment due date for 2021 estimated tax Jan. Installment payment due Sept.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Pennsylvania Pa Tax Forms H R Block

Comptroller Extends Filing Deadline For Business Tax Returns Payments Conduit Street

What To Know About Covid 19 And Taxes Deadline Delays The Cares Act And More

Quarterly Tax Calculator Calculate Estimated Taxes

What Does The March 1 Deadline Mean For Farmers Center For Agricultural Law And Taxation

Estimated Tax Payment Deadlines Have Changed But You Still Have Calculation Options Don T Mess With Taxes

Tax Season 2021 These States Updated Their Tax Deadlines

Indiana Taxpayers Should See Direct Deposit Refund Checks Soon

20 Printable Indiana Es 40 2017 Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Indiana Sales Tax Rate Rates Calculator Avalara

Some States 2020 Estimated Tax Payments Due Before 2019 Tax Returns

Indiana Estimated Tax Payment Form 2021 Fill Online Printable Fillable Blank Pdffiller

Federal And State Payments Electronic Funds Withdrawal Setup

2020 Tax Deadline Changes Due To Covid 19 Somerset Cpas And Advisors

When Are Quarterly Taxes Due In 2022 Dates To Bookmark

2022 Federal Tax Deadlines For Your Small Business

Indiana Extends Tax Filing And Payment Deadlines Insights Ksm Katz Sapper Miller